Job Order Costing System – Managerial Accounting

- Description

- Curriculum

- FAQ

- Reviews

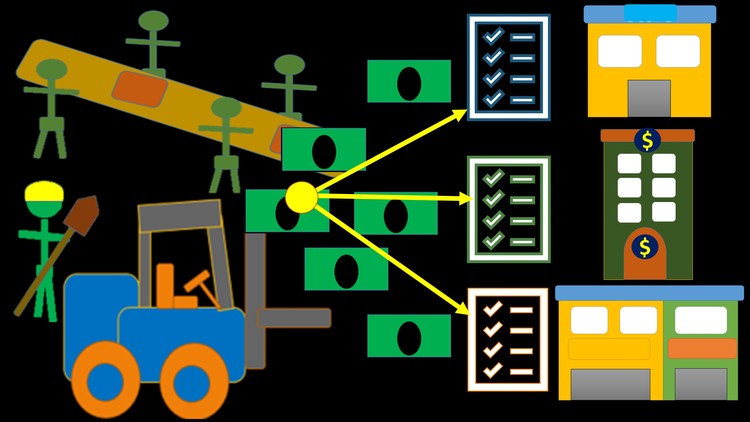

Job cost system – Managerial Accounting

We will start by introducing managerial accounting or cost accounting topics that apply to companies that manufacture using either a job cost system or a process cost system.

The course will describe classifications for costs and the importance of being able to classify costs in different ways.

We will list and describe an outline of the process costs go through as they flow through the accounting process in a manufacturing company.

The course will compare the two major systems used to track inventory costs in a manufacturing company, the job cost system, and the process costs system. We will discuss when a company would use either a job cost system or a process cost system.

We will discuss the flow of inventory costs in a job cost system and track the process of costs related to raw materials, that then flow to work in process and factory overhead, to finished goods, and finally, are expensed in the form of cost of goods sold.

The course will list and describe key documents in the job cost system, documents that facilitate and help record the flow of costs in the system.

We will explain the concept of overhead and why it is needed, including the concept of actual overhead incurred and estimated overhead we apply to jobs. The course will show how to calculate the predetermined overhead rate and how to use this rate to estimate overhead allocated to jobs.

The course will record the journal entries related to costs as they flow through the job cost system including journal entries for the transfer of raw materials to work in process and factory overhead, the incurrence of direct and indirect wages, and other overhead costs. We will enter journal entries to allocate overhead to work in process and to close out finished jobs from work in process to finished goods. We will also enter journal entries to record the sale and related costs of finished jobs.

We will also discuss key terms and definitions related to a job cost system and how they are used in practice.

In addition to the instructional videos, this course will include downloadable

• Downloadable PDF Files

• Excel Practice Files

• Multiple Choice Practice Questions

• Short Calculation Practice Questions

• Discussion Questions

The PDF files allow us to download reference information we can use offline and as a guide to help us work through the material.

Excel practice files will be preformatted so that we can focus on the adjusting process and learning some of the basics of Excel, like addition, subtraction, and cell relationships.

Multiple choice example question helps us improve our test-taking skills by reducing the information into the size and format of multiple choice questions and discussing how to approach these questions.

Short calculation questions help us reduce problems that have some calculation down to a short format that could be used in multiple choice questions.

Discussion Question will provide an opportunity to discuss these topics with the instructor and other students, a process many students find very helpful because it allows us to see the topic from different viewpoints.

Who will we be learning from?

You will be learning from somebody who has technical experience in accounting concepts and in accounting software like QuickBooks, as well as experience teaching and putting together curriculum.

You will be learning from somebody who is a:

• CPA – Certified Public Accountant

• CGMA – Chartered Global Management Accountant

• Master of Science in Taxation

• CPS – Certifies Post-Secondary Instructor

• Curriculum Development Export

As a practicing CPA the instructor has worked with many technical accounting issues and helped work through them and discuss them with clients of all levels.

As a CPA and professor, the instructor has taught many accounting classes and worked with many students in the fields of accounting, business, and business applications.

The instructor also has a lot of experience designing courses and learning how students learn best and how to help students achieve their objectives. Experience designing technical courses has also benefit in being able to design a course in a logical fashion and deal with problems related to technical topics and the use of software like QuickBooks Pro.

-

52 Cost ClassificationsVideo lesson

-

6PDF - 20 Cost ClassificationsVideo lesson

-

720 Cost ClassificationsVideo lesson

-

8PDF - 30 Product Costs & Period CostsVideo lesson

-

930 Product Costs & Period Costs.ENCODINGVideo lesson

-

10PDF - 40 Direct Materials Labor & OverheadVideo lesson

-

1140 Prime Costs & Conversion CostsVideo lesson

-

1210 Discussion Question - Job Cost SystemText lesson

-

13Accounting Comic BreakVideo lesson

-

143 Manufacturer’s Financial StatementsVideo lesson

-

15PDF - 50 Manufacturer's Balance SheetVideo lesson

-

1650 Manufacturer's Balance SheetVideo lesson

-

17PDF - 60 Manufacturer's Income StatementVideo lesson

-

1860 Manufacturer's Income StatementVideo lesson

-

1910 Multiple Choice Questions – Job Cost SystemVideo lesson

-

2020 Discussion Question - Job Cost SystemText lesson

-

21Accounting Comic BreakVideo lesson

-

224 Cost Flows For a Manufacturing CompanyVideo lesson

-

23PDF - 70 Manufacturing Activities FlowVideo lesson

-

2470 Manufacturing Activities FlowVideo lesson

-

25PDF - 80 Just In Time (JIT) ManufacturingVideo lesson

-

2680 Just In Time (JIT) ManufacturingVideo lesson

-

2720 Multiple Choice Questions – Job Cost SystemVideo lesson

-

2830 Discussion Question - Job Cost SystemText lesson

-

29Accounting Comic BreakVideo lesson

-

305 Job Cost vs Process Cost SystemVideo lesson

-

31PDF - 90 Job Cost vs Process CostVideo lesson

-

3290 Job Cost Vs Process CostVideo lesson

-

3330 Multiple Choice Questions – Job Cost SystemVideo lesson

-

3440 Discussion Question - Job Cost SystemText lesson

-

35Accounting Comic BreakVideo lesson

-

366 Cost Flows for a Job Cost SystemVideo lesson

-

37PDF - 100 Job Order Cost FlowsVideo lesson

-

38100 Job Cost System Cost FlowVideo lesson

-

3940 Multiple Choice Questions – Job Cost SystemVideo lesson

-

4050 Discussion Question - Job Cost SystemText lesson

-

41Accounting Comic BreakVideo lesson

-

427 Job Cost Documents and FormsVideo lesson

-

43PDF - 110 Job Cost SheetVideo lesson

-

44110 Job Cost SheetVideo lesson

-

45PDF - 120 Materials Ledger Card RequisitionVideo lesson

-

46120 Materials Ledger Card & Materials RequisitionVideo lesson

-

47Excel DownloadVideo lesson

-

48Worksheet - 120 Materials Ledger Card RequisitionVideo lesson

-

49PDF - 130 Time Ticket and Labor EntryVideo lesson

-

50130 Time Ticket & Labor Journal EntryVideo lesson

-

51Excel DownloadVideo lesson

-

52Worksheet - 130 Time Ticket and Labor EntryVideo lesson

-

5350 Multiple Choice Questions – Job Cost SystemVideo lesson

-

5460 Discussion Question - Job Cost SystemText lesson

-

55Accounting Comic BreakVideo lesson

-

568 Overhead Costs & AllocationVideo lesson

-

57PDF - 140 Overhead CostsVideo lesson

-

58140 Overhead CostsVideo lesson

-

59Excel DownloadVideo lesson

-

60Worksheet - 140 Overhead CostsVideo lesson

-

61PDF - 150 Overhead AllocationVideo lesson

-

62150 Overhead Allocation Predetermined Overhead RateVideo lesson

-

63Excel DownloadVideo lesson

-

64Worksheet - 150 Overhead AllocationVideo lesson

-

65PDF - 160 Under & Over applied OverheadVideo lesson

-

66160 Overhead Under Applied Over AppliedVideo lesson

-

67Excel DownloadVideo lesson

-

68Worksheet - 160 Under & Over applied OverheadVideo lesson

-

6960 Multiple Choice Questions – Job Cost SystemVideo lesson

-

7070 Discussion Question - Job Cost SystemText lesson

-

71Accounting Comic BreakVideo lesson

-

729 Finished Jobs and Sales Journal EntriesVideo lesson

-

73PDF - 170 Finished Goods Journal EntryVideo lesson

-

74170 Finished Jobs Journal EntryVideo lesson

-

75Excel DownloadVideo lesson

-

76Worksheet - 170 Finished Goods Journal EntryVideo lesson

-

77PDF - 180 Sale of JobsVideo lesson

-

78180 Sale of JobsVideo lesson

-

79Excel DownloadVideo lesson

-

80Worksheet - 180 Sale of JobsVideo lesson

-

8170 Multiple Choice Questions – Job Cost SystemVideo lesson

-

82Short CalculationVideo lesson

-

8380 Discussion Question - Job Cost SystemText lesson

-

84Accounting Comic BreakVideo lesson

External Links May Contain Affiliate Links read more